The number of jobseeker benefits has increased by roughly 30,000 (25%) in just four weeks. It took six months for a similar increase during the Global Financial Crisis (GFC). There has never been a bigger monthly increase in our data back to 1960.

Job loss is an easily understood and ‘real’ economic indicator. Jobseeker benefit numbers are one indicator of job losses. The Ministry of Social Development (MSD) is releasing weekly Jobseeker Benefit numbers. There had been around 145,000 Jobseeker beneficiaries in the lead up to COVID-19. Four weeks later, on 17 April 2020, it had increased to nearly 175,000.

The number of Jobseeker benefits, relative to population, is now just above the peak during the 2008-09 GFC recession, when the unemployment rate peaked at 6½%. The speed of labour market deterioration is unprecedented in New Zealand’s history.

FIGURE 1 THE NUMBER OF JOB SEEKER BENEFITS RELATIVE TO POPULATION HAS ALREADY RISEN TO LAST RECESSION’S HIGHS

Sources: Sense Partners from Lattimore & Eaqub (2011), “The New Zealand Economy: An Introduction”, Statistics New Zealand, MSD

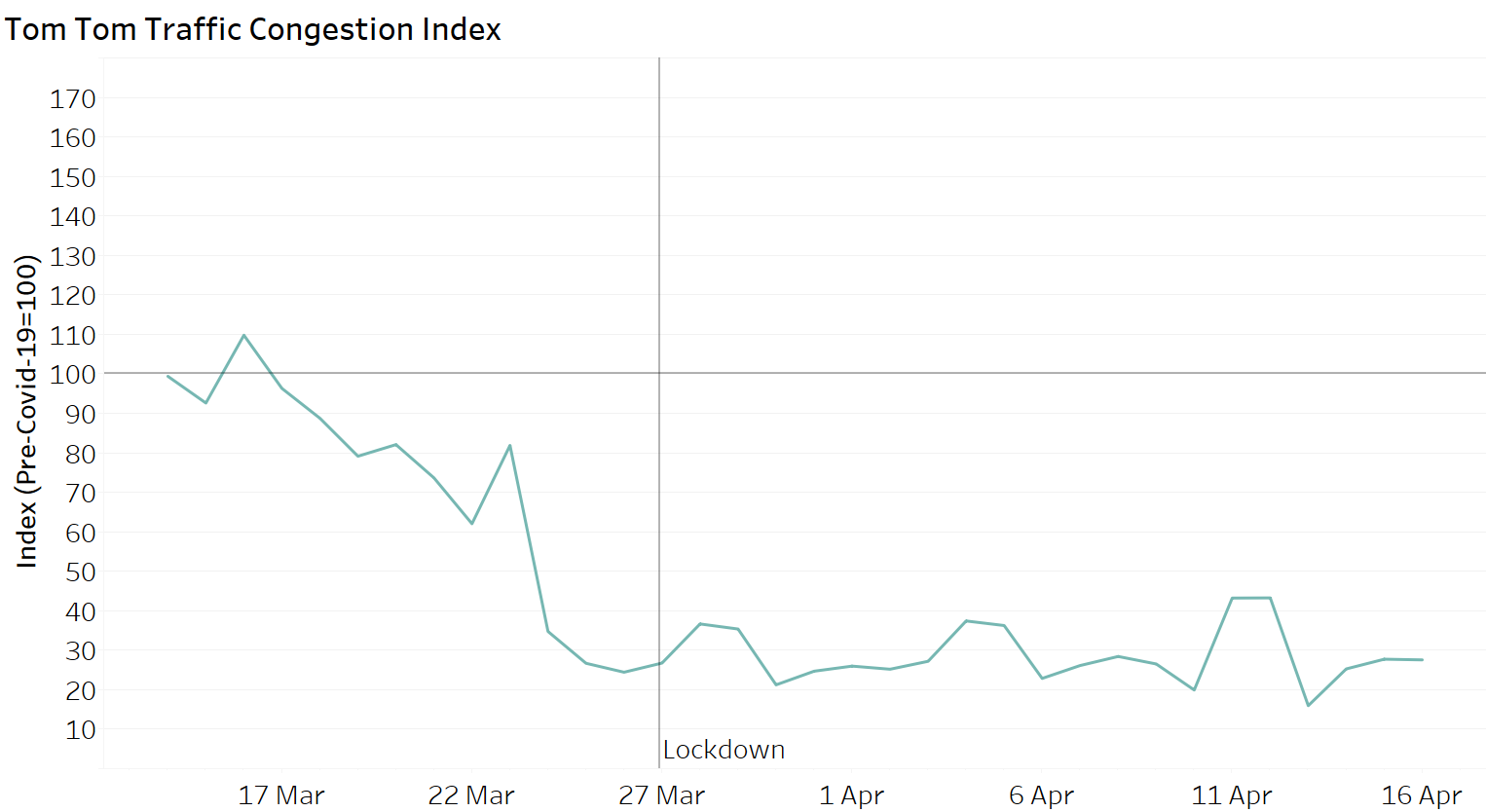

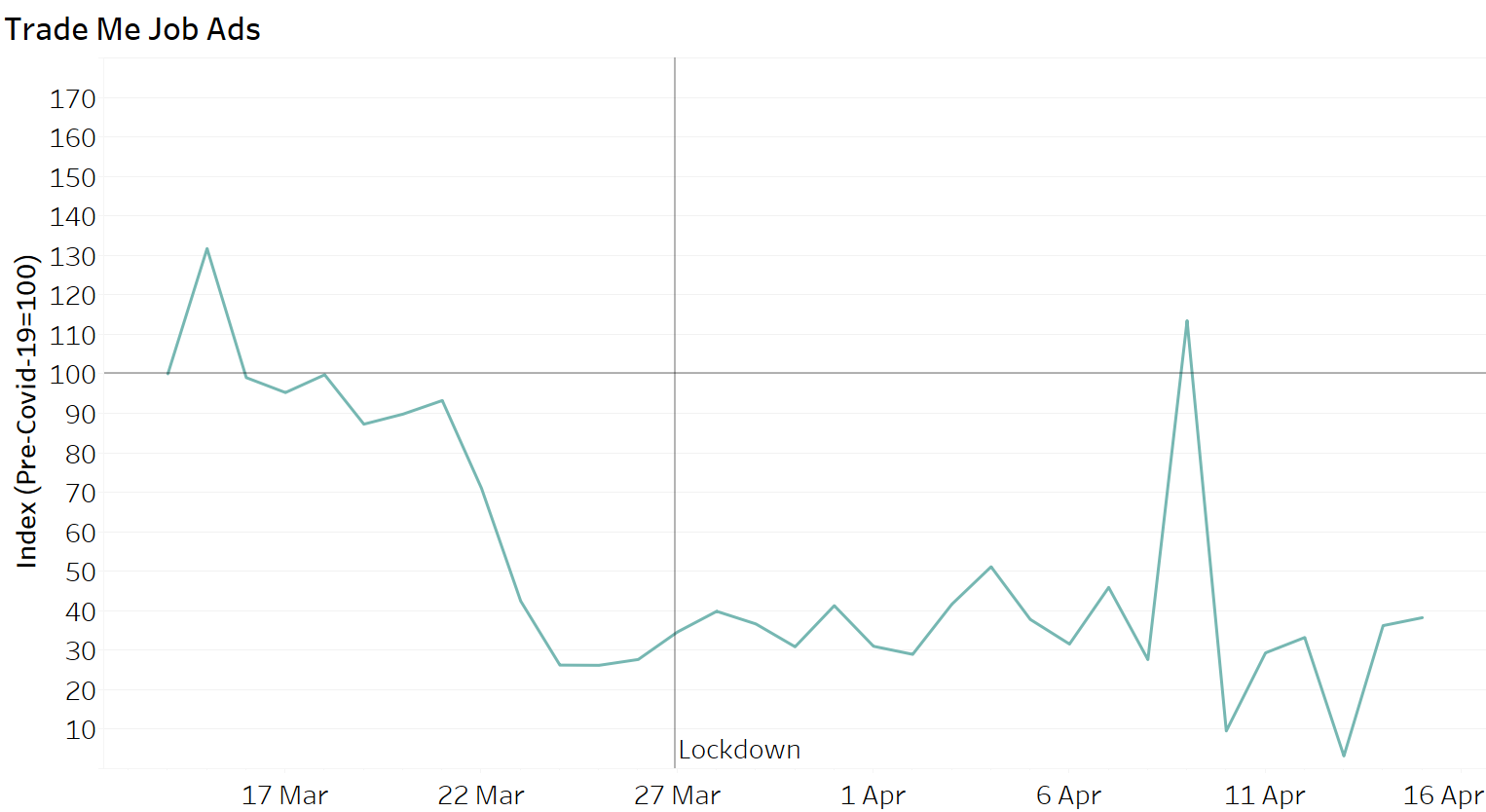

What these numbers do not show is that many employed will be working fewer hours. There is more spare capacity in the labour force than indicated solely by unemployment numbers. More people are looking at job ads on TradeMe in recent days, as our activity tracker shows.

We will face further waves of business closures and job losses in coming weeks and months. This recession will surpass anything in living memory.

FIGURE 2: THE LATEST ‘EXCESS’ INCREASE IN JOBSEEKER BENEFITS IS 31K, AFTER ACCOUNTING FOR THE LEVEL OF WEEKLY BENEFIT APPLICATIONS THIS YEAR BEING 13k HIGHER THAN LAST YEAR.

Source: MSD

FIGURE 3: JOB LOSSES ARE WIDESPREAD, BUT LARGEST IN THE PROVINCES

Source: MSD